Convertible Bonds Advantages and Disadvantages

Thus the company is required to pay interest to its creditor. We will evaluate following types of bonds and their positive and negative sides.

Convertible Bond Everything You Need To Know Eqvista

Bonds advantages and disadvantages is a subject that has been quite often researched.

. The advantages for investors in holding convertible bonds center on their ability to participate in the fortunes of the company without a direct equity holding. You may be surprised about what you read. More risk of volatility of the market as more than one economy come into picture.

Pursue Your Goals Today. EPS or Earning Per Share rate of the stocks of a company go down. Convertible Bonds advantagesdisadvantages Lower Interest Rate - The benefit to the issuer of convertible bonds is that investors will accept a lower interest rate since there is potential price.

Many companies continue to use. The main advantages which attract investors to reverse convertible bonds have been listed below. Invest Online or Over the Phone.

Invest Online or Over the Phone. You might have to make periodic interest. Firstly it is important to note that reverse convertible bonds provide a.

Convertible bonds work like a traditional loan. Ad Browse Discover Thousands of Business Investing Book Titles for Less. Search For Highest Rated Bond Funds that are Great for You.

Ad Learn why conservative investing might not be as safe and prudent as it sounds. There is a risk of exchange as the interest is to be. Disadvantages of foreign currency convertible bond.

Ad The Investing Experience Youve Been Waiting for. Find Funds That Outperformed Peers. Bullet bond is a simple.

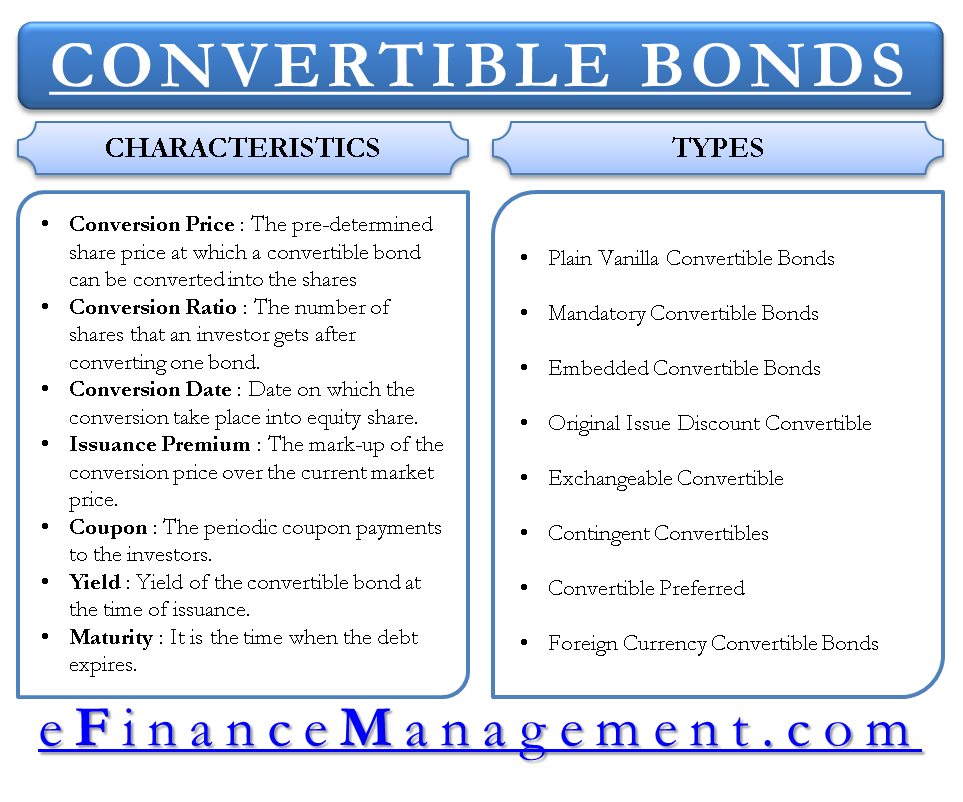

Retirees beware of this conventional wisdom. Until the debt is converted into equity you must service the loan according to the terms of the agreement. The conversion ratio measures the number of shares of.

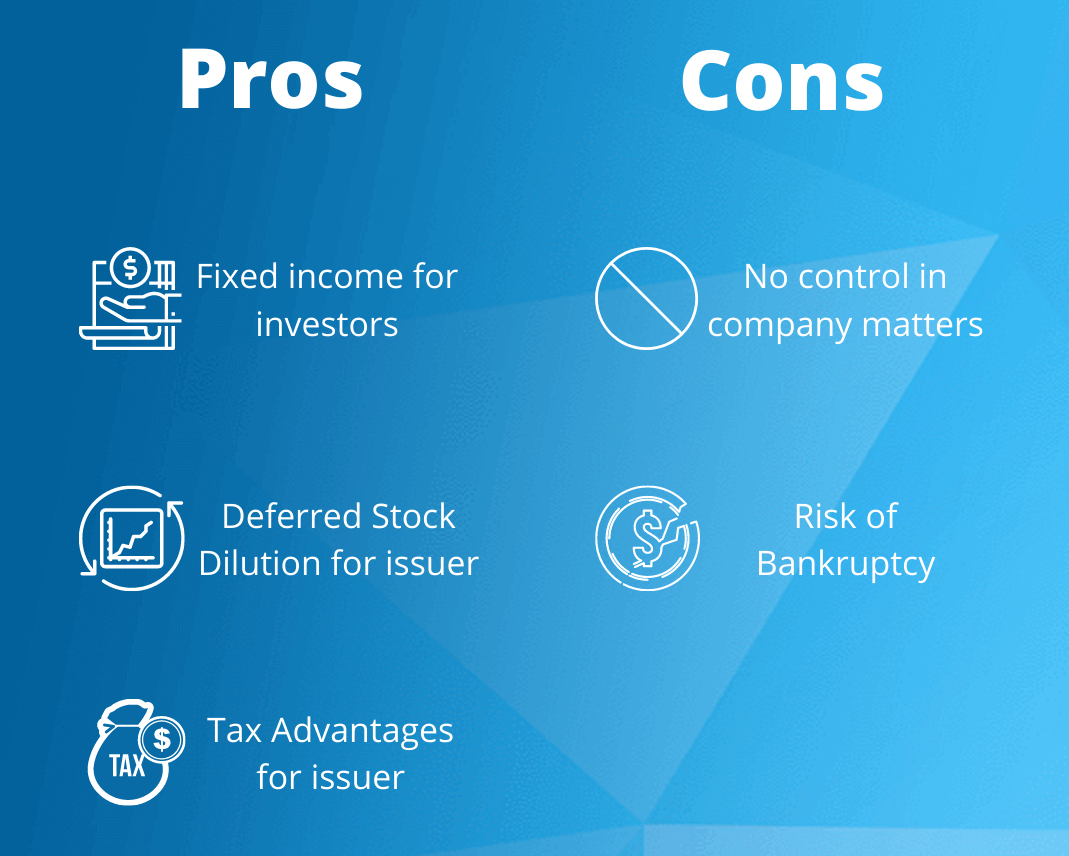

Ad Search For Highest Rated Bond Funds at Discoverthebestco. Other disadvantages mirror those of utilizing straight debt although convertible bonds do entail a greater risk of bankruptcy than preferred or common stocks and the shorter. Ad Add Income and Capital Appreciation Potential to Your Investment Portfolio.

Start Your Investing Education. Advantages and Disadvantages Of Convertibles From the issuers perspective the key benefit of raising money by selling convertible bonds is a reduced cash interest payment. Find Funds That Outperformed Peers.

In this article we will have a closer look at some of the advantages and disadvantages of using this form of debt. Learn About Stocks Bonds Futures and More. Ad Add Income and Capital Appreciation Potential to Your Investment Portfolio.

In a typical convertible bond the bondholder is given the option to convert the bond into a specified number of shares of stock. Advantages of Using Convertible Debt. Other disadvantages mirror those of utilizing straight debt although convertible bonds do entail a greater risk of bankruptcy than preferred or common stocks and the.

A The value retained for the shares subsequently converted. The few disadvantages which also accompany the advantages of convertible securities are listed below.

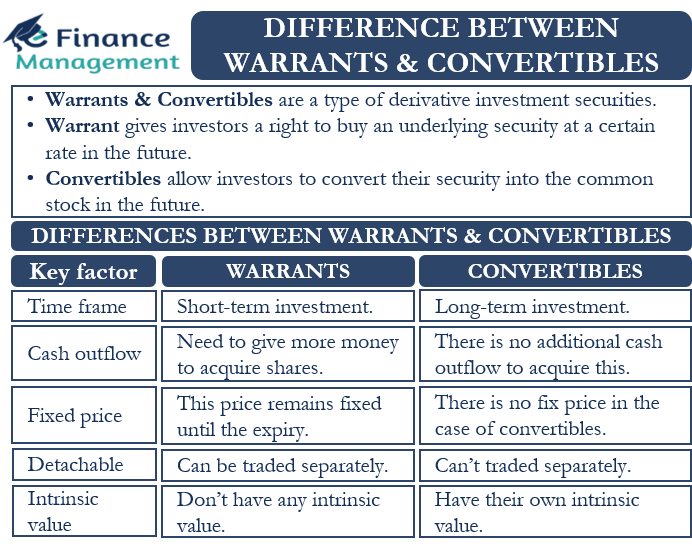

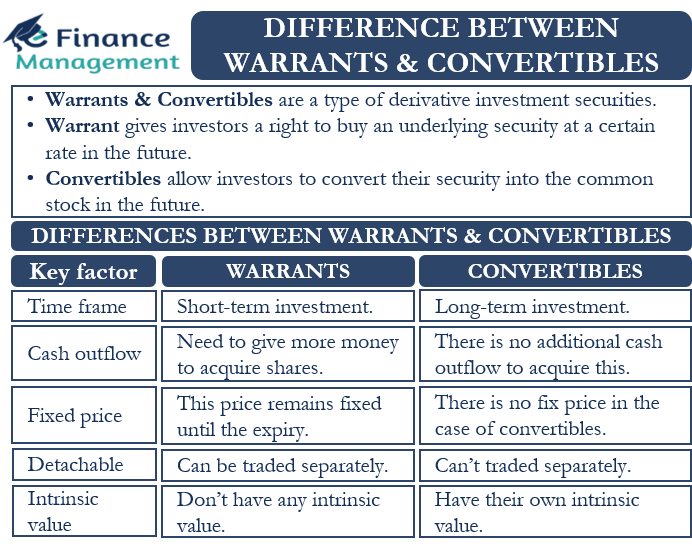

Difference Between Warrants And Convertibles Efinancemanagement

What Are Convertible Bonds Forbes Advisor

Convertible Bonds Efinancemanagement

Convertible Bonds Primer On Conversion Features Of Debt Securities

0 Response to "Convertible Bonds Advantages and Disadvantages"

Post a Comment